Grassroot Corporate Bitcoin Strategy

Companies are including Bitcoin into their basket of capital preservation vehicles

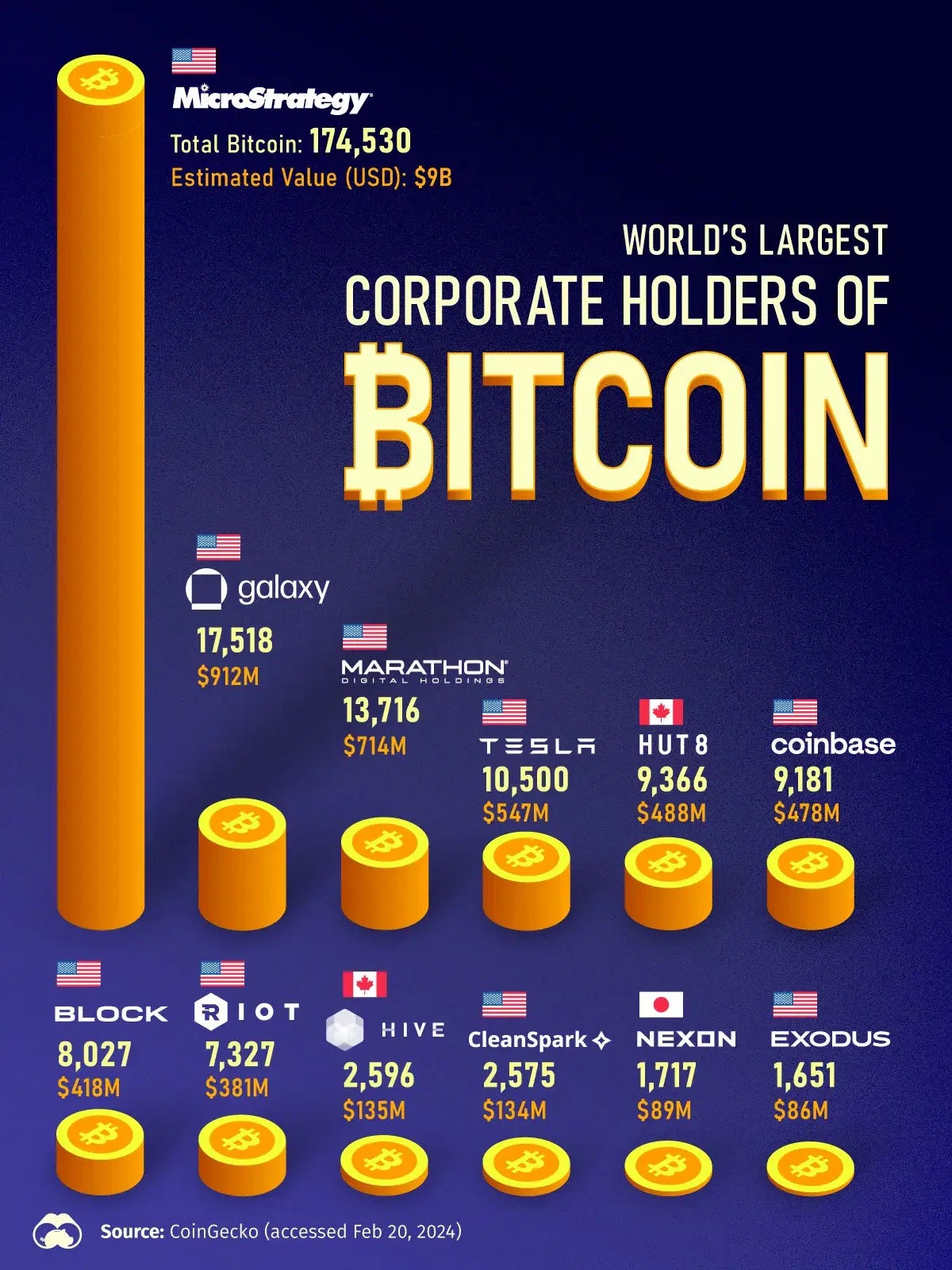

The purpose of this article is to demonstrate the strategy and rationale behind why companies are now adopting Bitcoin into their business model. Several small and major companies have acquired Bitcoin on their balance sheet. Quite a few of them have held for years and continue to accrue Bitcoin. Some of the major companies holding Bitcoin include Block (the old Square), Tesla, and MicroStrategy. These are companies that originally did not have anything to do with Bitcoin. The inclusion of Bitcoin to their business model is very specific—namely, long-term capital preservation.

Companies are utilizing different ways of storing capital. As the unit value of all fiat currencies decreases, all companies search to store their capital in a suitable vehicle. Large amounts of resources are used to strategize and maintain the best vehicle for capital preservation. One key factor that complicates the strategies is timing risk. Choosing a volatile asset to store wealth can have a high risk for short- and medium-term capital preservation due to the possibility of retrieving capital in a temporary price drop. This is why the timing risk has to be considered when choosing the asset. That is also why companies use many different vehicles for their capital preservation. An example of a strategy can be cash for short-term, bonds for medium-term, and a stock index for long-term capital preservation. Of the three, cash historically performed the worst as a store of value, however, it has also been less volatile. Bonds have held value worse than the stock index, but better than cash. Bonds have also been in the middle in terms of volatility. Finally, the stock index has performed better than both cash and bonds as a store of value, but has been more volatile than both, and therefore had higher timing risk.

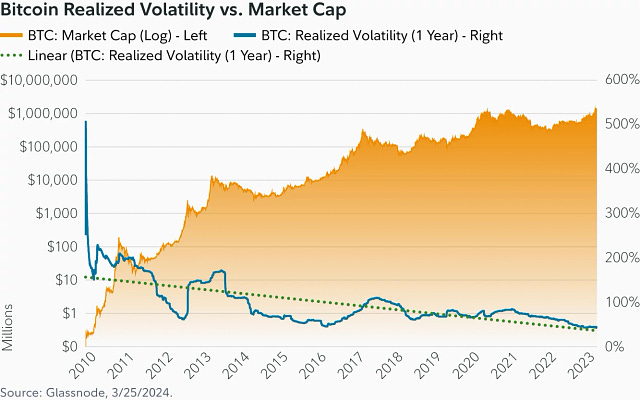

It is an understatement to say that this basket of assets is an important mechanism in the inflationary environment we are in. Without it, companies would be severely hindered in their ability to save capital for future investment. Companies would then be forced to reduce their time horizon concerning investment and shorten their investment cycles. More advanced projects requiring long-term savings would become uneconomical. The companies that have utilized Bitcoin, have in large, included it in their basket of assets meant to preserve their capital. In this basket, Bitcoin’s role has mainly been as the long-term store of value. Like the stock index has outperformed both bonds and cash, so has Bitcoin outperformed the stock index. Also, Bitcoin has remained quite a bit more volatile than all the mentioned assets, which consequently gives it the highest timing risk out of the four.

It is worth noting that Bitcoin has not existed for long compared to other conventional stores of value, and has therefore not yet proven to be a long-term store of value. Even so, to put into perspective how large of a leap it’s already done, we can measure its performance against all other assets. A rough estimate of total assets in the world in 2024 is 400 trillion USD. Bitcoin has gone from its inception, zero, to a market cap valuation of around 1.4 trillion in 2024. That is 0.35% of global wealth! To reach such a high monetary value that fast is unprecedented. Notably, the value of this asset has risen exclusively through the market process. There has been no enforcement nor incentive from any government. Purely through individual people and businesses, have Bitcoin reached its monetary value.

The timing risk in Bitcoin has shown to be great given a one to two year time horizon. Since Bitcoin’s liquidity is still magnitudes smaller compared to bonds and stock indexes, it will likely remain a high timing risk asset for some more time. Nonetheless, its timing risk is lowering, and when the timing risk lowers, its use case expands. Companies can consequently allocate capital that has a lower time horizon into Bitcoin. This will increase the percentage of capital a company can responsibly allocate. Afterward, volatility and timing risk are again reduced, allowing even more capital to flow into Bitcoin. The described self-reinforcement mechanism could play a big part in its future and the future of capital preservation.